INVESTMENT

We are an emerging private equity group operating as a holding company,

dedicated to acquiring and nurturing high-potential businesses to drive

long-term value creation..

Our Criteria

Legacy Businesses Built on Grit, Integrity, and Operational Strength

Companies in Transition

At Omega Private, our investment strategy is centered on acquiring family-owned and founder-led businesses that are at a natural transition point — often with no formal succession plan in place or owners seeking retirement. We view these moments not as exits, but as opportunities to preserve legacies, support employees, and unlock sustainable growth.

Our Approach-Buy to Hold, Partner to grow

We prioritize long-term value creation over quick exits. Our investment model is grounded in patience, partnership, and operational collaboration. Post-close, we work hand-in-hand with management teams to develop actionable growth strategies, preserve company culture, and enhance operational excellence.

Headline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quorum altera prosunt, nocent altera. Istic sum, inquit.

Since 2019

This is where you write about the

inception of your product

Baked Not Fried

This is where you mention

the USP of your product

100k Units Sold

This is where you establish

the trust for your product

Our Featured Courses

Checkout our most popular courses. These are recently updated with all new content.

Target Businesses

Describe in a few words what this course is about, who is this course for, and how is this course going to help your audience go from where they to where they desire to be, within a fixed time frame.

Get Clients Fast

Describe in a few words what this course is about, who is this course for, and how is this course going to help your audience go from where they to where they desire to be, within a fixed time frame.

Scale Your Agency

Describe in a few words what this course is about, who is this course for, and how is this course going to help your audience go from where they to where they desire to be, within a fixed time frame.

Creation of Value

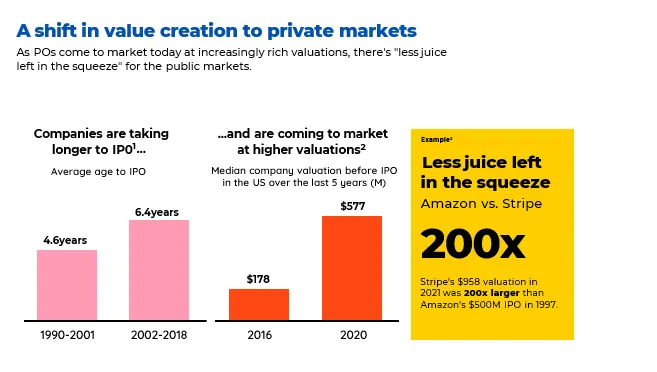

There is a tremendous opportunity to create value in the private markets.

SEE OUR TESTIMONIALS

Private Market Increase

People are looking for an alternative to the public market where they have lost their entire

ORDER YOURS NOW

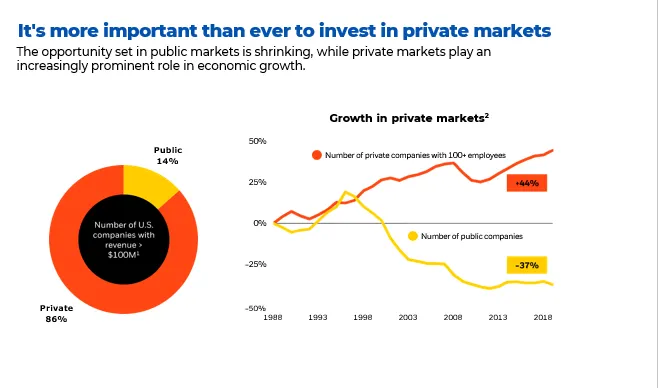

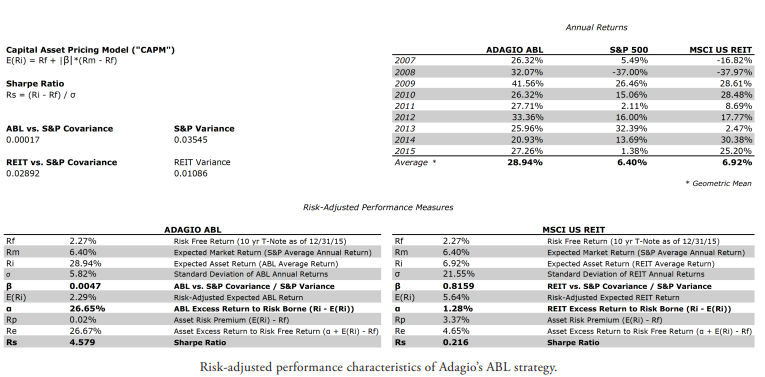

Our Strategy Highly Performs

When a crisis occurs, our strategy is designed to perform even better.

Our investment strategy considers that investment gains and losses are not realized in a vacuum free from the effects of global economic turbulence and market irrationality and the difficulties inherent in predicting these investment phenomena. As a result we believe successful long-term investment demands rigorous and proactive management of a portfolio's risk/reward profile. Through effective risk management structure, management, education, and communication we deliver risk-adjusted performance that demonstrably exceeds what is otherwise available through the public capital markets.

ABL Fund & 2008 Financial Crisis

The picture to left is a perfect example of how our portfolio is designed. No one could have predicted the worse economic crisis our country faced since the Great Depression in regard to the 2008 crisis. The design of the ABL portfolio allowed the fund to do even better during the unexpected economic crisis. The fund was prepared for unexpected. As you can see the returns on the ABL fund were dramatically higher in the heat of the crisis, generating 30%-+40% returns during this time. Our portfolio is still designed to prepared for the unexpected, and should it happen, do even better.

Summers Alternative Risk Rating

Our portfolio manager, Benjamin Summers, developed a proprietary matrix that distills the most informative risk-adjusted performance metrics into a concise rating system. This system takes into account all four statistical moments (geometric mean, variance, skewness, and kurtosis) of both systematic and idiosyncratic risk, including potential loss.

By utilizing performance data encompassing a minimum of one complete market cycle, our portfolio is able to meaningfully capture market, idiosyncratic and tail risk. For newer asset managers, Ben is able to construct theoretical track records encompassing a complete cycle by rigorously accounting for every measurable variable that contributes to their overall performance. You can learn more about Adagio risk analytics by clicking below.

The Next Crisis

There has been a common theme in regard to each financial crisis, and that is they consistently become bigger than the last one. The Federal Reserve has not allowed the economy to correct itself and recover, letting assets and resources be allocated to where they would be best served. Instead, invariably, the Fed stimulates the economy, injecting more money in the very place it shouldn't have been in the first place, propping up the economy to an imbalance even higher than it was before.

UNDERSTANDING INVESTMENT STRUCTURES

Private Equity and Traditional Portfolios

When a crisis occurs, our strategy is designed to perform even better.

What exactly are capital markets? Capital Markets are the result of supply and demand where securities are held for a minimum of one year and are bought and sold generally through intermediaries called broker-dealers. Markets include mechanisms to determine the price of traded assets, communicate price information, facilitate transactions, and effect distribution. As a result of the Federal Reserve monetary policy, there is approximately $20 trillion held in savings by US workers who are in demand of decent, low-risk, real yield that is unmet by traditional financial assets. This creates a tremendous opportunity for private security issuers to meet that demand.

What are private securities?

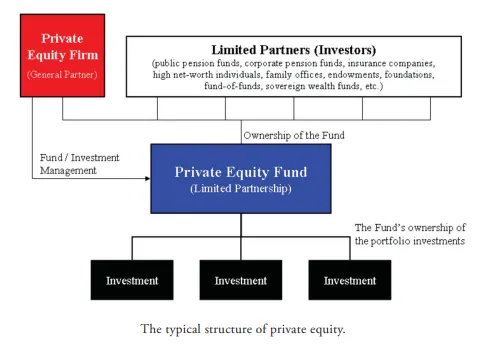

This picture illustrates the typical private equity structure. Shares of equity in private businesses are not available for public purchase like the stock of publicly traded companies. There are a few different types of private investment companies, and they all fall under the category of alternative assets. Most in the financial advisor community would agree that Reg D funds have a pretty bad reputation in general. However, the opportunity to generate substantial risk-adjusted performance can almost only be accomplished in the private fund space. Most private investments are objected to because of a lack of transparency. Our fund however, utilizes a third part administrator, we issue at a minimum quarterly financial reports, and have our fund audited annually by a nationally recognized accounting firm.

Traditional Portfolios

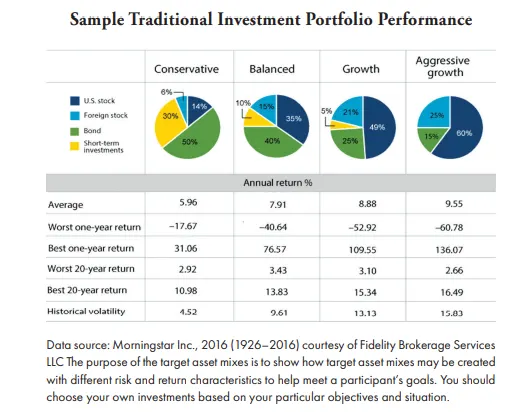

The vast majority of financial advisors are driven by regulatory and revenue considerations to take a very generic, cookie-cutter approach to portfolio construction and most offer just a few basic options, as illustrated on the picture to the right. Where the financial advisor constructs a portfolio based on individual risk appetite and growth needs-so you pick a box.

As you can see from from the picture however, the "conservative" portfolio lost almost 20% in its most down year. How can that possibly be seemed safe by any standard? No matter how you slice it, the results of traditional portfolio construction are not awesome, and regardless of these standard portfolio performance, the financial advisor's compensation is unchanged and in fact most are dis-incentivized by regulatory risk to do anything other than construct that fit this dismal template. Compare the picture to right to the results of the Adagio ABL fund above. There is absolutely not comparison.

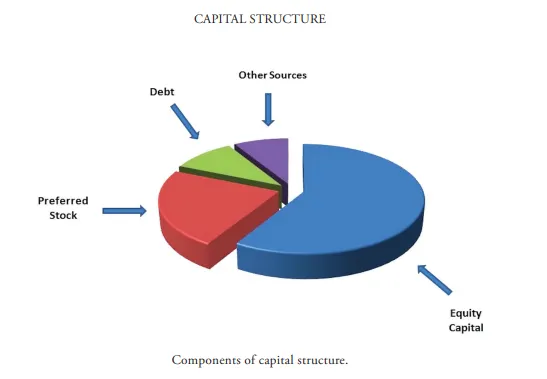

Capital Structure

What defines a capital structure? It is the combination of debt and equity instruments used to finance assets, including business. In general, when these instruments are sold they are called securities. In capital market terms borrowing is the act of issuing/selling debt or notes that promise the purchaser a steady stream of fixed income. Debt, however, is only one type of financial instrument that can issued. Equity, or ownership interests can also be bought and sold. This allows the purchaser to participate in an asset's profits. People are generally aware of public equities like Apple or Exxon Mobil, but private companies can also sell shares in their ownership to raise capital.

What We Can Do for You

Our highly skilled investment team is ready to help you. Whether you are an individual investor, RIA, non-profit organization or family office, our investment strategies will not just grow your portfolio but is designed for explosive growth should a crisis occur.

Individual Investors

We work with individual investors to help them understand the risk measures of their portfolio. Rather just worrying about collecting a commission, we work to create uniquely valuable solutions for you. You do not have to endure and try to recover from another market crisis.

Family offices, Non-Profits, Endowments, Pensions

How can you achieve responsible growth and capital preservation (especially across down cycles and market crisis) if you haven't measured an asset or asset manager's sensitivity to the market across at least one previous complete market cycle? We can help you grow and protect the capital to which you've been entrusted.

RIA

How valuable would it be to your business if you could clearly and confidently identify quality, low-risk alternatives that meet your clients' objectives in ways not possible with any boilerplate allocation to public equities, bonds, and mutual funds? Wouldn't it be great to be able to provide your clients with products that are demonstrably better?

GET IN TOUCH

Are you interested in learning how to not just grow your assets, but to have them not just protected but to grow even more during during a crisis?

We are looking forward to learning more about your investment goals. Click below to schedule an appointment.

© 2025 Omega Private Equity dba Private Equity Fund.